Li-Cycle: A Battery Recycler With An Attractive Long Term Opportunity

In the News

March 21, 2022

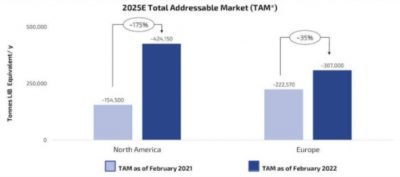

Summary Li-Cycle is growing its customer base beyond North America to Europe, with its recent partnership with Morrow Batteries. The company’s spoke and hub expansion is being executed well by...

Learn more →