March 21, 2022

Summary

March 17, 2022

Original article published in Seeking Alpha

Li-Cycle (NYSE:LICY), along with other growth companies without profitability, has been hit with negative sentiment in the past few months, with the year to date performance being down 20%.

However, I am of the opinion that as of my last article in late December 2021, Li-Cycle’s fundamentals have actually improved and the company has shown commercial traction. Thus, I think that Li-Cycle is currently at a position where it looks very attractive as a long-term investment.

As I mentioned, I have written an earlier article on Li-Cycle which can be found here. This initiation article highlights the case for battery recycling over mining as well as the prospects of battery recycling, amongst other things.

Li-Cycle could be a leader in lithium ion battery recycling sector, an early stage but fast-growing industry for the next few decades to come. Li-Cycle’s technology advantage and patented business model is underappreciated by the market.

My investment thesis from my initiation article continues to hold and I am increasingly convinced that Li-Cycle is well positioned to be the leader in lithium ion battery recycling, which will be further explained below.

Li-Cycle is the leading lithium-ion battery recycler in the US. The company recycles battery manufacturing scrap or end of life batteries into its constituent raw materials like Nickel, Lithium, Manganese.

The company’s business model utilises a hub-and-spoke expansion model that enables it to expand and scale quickly while maximising economies of scale. Its recycling technology that involves mechanical and hydrometallurgical processes is patented and results in higher recovery rates than competitors and has several other benefits over other battery recycling methods.

Li-Cycle announced that it partnered with Univar Solutions, a leader in waste management, to leverage on its expertise in collecting, sorting and managing waste of several large OEM players, including Mercedes-Benz (OTCPK:DDAIF, OTCPK:DMLRY). Based on some checks, I found that the 4th spoke in Alabama is located near the Mercedes-Benz EV assembly plant, which will be the first OEM that the Univar Solutions partnership will bring. The Mercedes-Benz plant will be operational in early 2022, producing EQE and EQS EVs, while Alabama spoke facility will be operational by the middle of 2022.

Li-Cycle launched its first international spoke in Europe (Norway) with Morrow Batteries and ECO STOR. Morrow batteries is a battery cell manufacturer which is developing a 43 GWh megafactory in Norway. Morrow’s battery manufacturing scrap will go to Li-Cycle’s Norway spoke, which will have 10,000 tons of capacity each year.

In addition, Li-Cycle is in advanced developments for a spoke in Germany, which could bring an additional new battery manufacturer or even an OEM into the customer mix.

I believe that this first spoke partnership with Morrow batteries and ECO STOR highlights the ability of Li-Cycle to expand into Europe and the value proposition it brings to battery manufacturers in securing key materials needed to manufacture batteries.

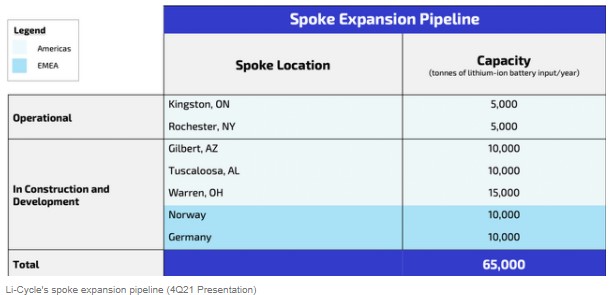

These newly announced spokes and partnerships bring Li-Cycle closer to its goal of 100,000 tonnes of spoke capacity by 2025, with 65% of these having been either operational or in construction and development phase.

As can be seen in the diagram above, there are two currently operational spokes in Kingston and Rochester, totalling 10,000 tons per year of capacity. The Arizona & Alabama spokes are expected to be operational in 2022 with a total additional capacity of 20,000 capacity per year, bringing the total capacity to be 30,000 tons per year by end 2022.

A new Ohio spoke was announced with 15,000 tons per year capacity and will be co-located at Ultium Cells battery megafactory and operate under a multi-year scrap off-take agreement. This will be operational in early 2023.

The first Europe spoke with Morrow Batteries and ECO STOR will be operational in early 2023 and will have a capacity of 10,000 tons per year. In addition, the Germany spoke which is targeted to have an additional 10,000 tons of capacity has not yet been officially announced yet, so the operational date is uncertain but I think that it might be also available sometime in 2023.

As such, by 2023, it is likely we will see spoke capacity increase to 65,000 tons per year, up from 30,000 tons per year of capacity in 2022 and 10,000 tons per year in 2021.

In addition, I think that it’s a good business strategy for Li-Cycle to contract and obtain a major anchor customer for each of its spokes before putting in the investments into spoke expansion, which is a very careful business expansion approach.

In 4Q21, black mass production increased more than six-fold year over year to 811 tons due to a small base in the prior year. In FY2021, total production was 1,880 tons from Li-Cycle’s two operating spokes. As a result, revenues increased from $0.8 million in FY2020 to $7.4 million in FY2021. Adjusted EBITDA was -$11.5 million for 4Q21 and -$25 million for FY2021, which was a result of increased staffing and costs related to expansion. Li-Cycle’s FY2022 guidance for production lies in the range of 6,500 tons to 7,500 tons of black mass production.

Furthermore, Li-Cycle reiterated its goal of achieving 100,000 tons of lithium-ion battery (LIB) equivalent processing capacity for its spoke network and 220,000 tons capacity for its hub network. In the near to medium term, Li-Cycle will focus on spoke expansion into North American & Europe, with megafactory capacity projected to grow to 500 GWh by 2025 in North America and 930 GWh in Europe. Although there were no specifics discussed, Asia-Pacific will be a key focus for opportunistic investments as it is the epicenter of megafactory ramp-up.

I think that Li-Cycle’s recent results and guidance show strong growth for a relatively new company, demonstrating that it is able to execute well on its plans.

Koch Strategic Platforms is Li-Cycle’s engineering partner, which will be deploying its Koch engineering capabilities and expertise in spoke fabrication, deployment and hub operational readiness. Koch invested in Li-Cycle through $100 million in convertible notes. In my opinion, this partnership can bring additional synergistic benefits for Li-Cycle. For example, Koch Strategic Platforms also invested in a Norway battery manufacturer start-up, which has intentions to look for battery recycling capabilities, based on their recent announcements.

LG Chem (OTCPK:LGCLF) announced an investment of $50 million into Li-Cycle. LG Chem is a leading battery manufacturer, with a 10-year contract with Li-Cycle to provide supply of scrap supply and for Li-Cycle to provide them with the recycled materials like Nickel. Furthermore, in my view, this partnership could be further expanded due to LG Chem’s global battery manufacturing operations.

These investments by Koch and LG Chem highlights the confidence that Li-Cycle’s partners and customers have in Li-Cycle and the high level of alignment between Li-Cycle and its partners.

I maintain my target price in my earlier article based on the improving fundamentals of Li-Cycle’s business. Peers in the waste and recycling sectors trade at 13x EV/EBITDA, assuming a conservative 40% discount to these established players, I assume a terminal 2025F EV/EBITDA of 7x. Based on the 2025F EBITDA of $541 million as per projections in the financials section, this implies an enterprise value of $2.7 billion. Hence, discounting this by the WACC of 9.1%, I derived my target price of $16.28, with 103% upside potential.

With Li-Cycle’s share price down 20% year to date, I think that this is an excellent entry point for Li-Cycle as it is an attractive long-term investment opportunity. Furthermore, as demonstrated in its recent quarter, and its recent spoke expansion announcements, Li-Cycle is expanding faster than expected and this is likely due to the strong demand for battery recycling. Lastly, the strong strategic investors that Li-Cycle has secured shows that partners and customers have confidence in Li-Cycle doing well in the future and shows the strong alignment of interests between them and Li-Cycle.