Original press release deployed via Business Wire

Highlights:

Expanded market-leading position and speed to market through growth of Spoke & Hub network in North America and Europe; on path to produce up to 25,000 tonnes of lithium carbonate per year;

Advanced construction of the Rochester Hub, maintaining start of commissioning in late 2023; successfully received and installed the largest piece of progress equipment on site – video link here;

Progressed development of European Hub (Portovesme Hub) with Glencore with Definitive Feasibility Study (DFS) expected to be completed by mid-2024;

Commercialized first European Spoke in Germany, largest in Li-Cycle’s global Spoke network and one of the largest on the continent;

Signed memorandum of understanding with EVE Energy to collaborate on global sustainable lithium-ion battery recycling solutions; exploring site selection for new Spoke in Hungary;

Advanced documentation for $375 million Department of Energy (DOE) loan to final stages, with close anticipated in September 2023; and

Ended June 30, 2023 with cash on hand of $288.8 million.

TORONTO, Ontario (August 14, 2023) – Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the “Company”), an industry leader in lithium-ion battery (LIB) resource recovery and the leading LIB recycler in North America, today announced a business update and financial results for its second quarter ended June 30, 2023.

“During the second quarter, we made significant strides on our strategic objectives, growing and operationalizing our Spoke & Hub network. In Europe, we successfully commenced processing battery materials at our Germany Spoke, our first in Europe, which is expected to become the largest pre-processing facility in our global Spoke network by the end of 2023. We are also progressing our co-development of the Portovesme Hub with Glencore with the DFS on track for completion by mid-2024. In North America, the Rochester Hub remains on schedule to commence commissioning in late 2023,” said Ajay Kochhar, Li-Cycle’s President and Chief Executive Officer.

Mr. Kochhar concluded, “As a result of our continued execution, we have further solidified Li-Cycle’s leadership role as a sustainable and pure-play domestic solutions provider for key battery-grade materials in North America and Europe. When both the Rochester and Portovesme Hubs are in full operation, Li-Cycle is expected to have total lithium carbonate production capacity of up to 25,000 tonnes per year, making Li-Cycle a top global and sustainable producer of lithium carbonate and key battery-grade materials.”

Commercial Arrangements

On July 11, 2023, Li-Cycle and EVE Energy, a leading lithium-ion battery technology company, signed a memorandum of understanding (MOU) to collaborate and explore lithium-ion battery recycling solutions for EVE battery materials. EVE is one of the world’s largest lithium-ion battery cell manufacturers, with global manufacturing facilities and customers that include global automakers.

The MOU includes a framework to explore global sustainable recycling solutions for EVE’s lithium-ion battery materials in the North American market, as well as battery manufacturing scrap generated at EVE’s planned lithium-ion battery cell manufacturing facilities in Hungary and Malaysia. In view of this commercial partnership, Li-Cycle is undertaking a site selection process for a potential new Spoke location in Hungary.

Global Network Expansion

Li-Cycle continued to build upon its significant first mover advantage as a critical domestic source of key battery-grade materials, supported by numerous strategic commercial partnerships and leading patent-protected sustainable technology. With projected Spoke pre-processing capacity of greater than 100,000 tonnes LIB equivalent and Hubs post-processing capacity of 85,000 to 105,000 tonnes of black mass, Li-Cycle is on the path to become the leader in lithium-ion battery resource recovery and a top global and sustainable producer of lithium carbonate (up to 25,000 tonnes of lithium carbonate per year), and key battery materials (e.g., nickel and cobalt), particularly in North America and Europe.

Europe

Along with its joint development partner Glencore, the Company continued to make positive strides in the development of the Portovesme Hub with the DFS work progressing and on schedule to be completed by mid-2024. Leveraging our strategic partnership, the Portovesme site is a strong fit with Li-Cycle’s proprietary process for metallurgical recovery of lithium and critical materials. With speed to market and lower capital intensity, we are developing an expedited flowsheet that requires fewer processing steps to produce lithium carbonate and a mixed hydroxide product (MHP) containing nickel and cobalt.

Subject to a final investment decision, the project would proceed to construction, with commissioning expected to commence in late 2026 to early 2027. Once operational, the Portovesme Hub would have an annual processing capacity of up to 70,000 tonnes per year of black mass, producing approximately 15,000 to 16,500 tonnes of lithium carbonate, as well as up to approximately 18,000 tonnes of nickel, and 2,250 tonnes of cobalt contained in MHP.

On August 1, 2023, Li-Cycle announced the start of operation of line one of its Germany Spoke, with an annual LIB capacity of 10,000 tonnes. The facility, which is the Company’s first in Europe, utilizes Li-Cycle’s patented and environmentally friendly ‘Generation 3’ Spoke technology to directly process all forms of LIBs, including full EV battery packs. The Germany Spoke will be the largest in the Company’s portfolio when fully operational, with a total annual processing capacity of up to 30,000 tonnes of LIB, including two lines of 10,000 tonnes each, in addition to ancillary processing capacity. The Company expects to operationalize the second line in late 2023.

North America

The Rochester Hub achieved significant milestones and remains on schedule to start commissioning in late 2023. Detailed engineering and procurement are nearly complete. Construction activities are progressing on site, with major buildings nearing completion, steel and concrete installation progressing, alongside the start of mechanical and electrical equipment installation. The Company is focused on actively managing the construction labor as part of the Rochester Hub construction budget of $560 million.

Li-Cycle successfully received and installed the largest piece of process equipment at the Rochester Hub, as can be viewed on this link.

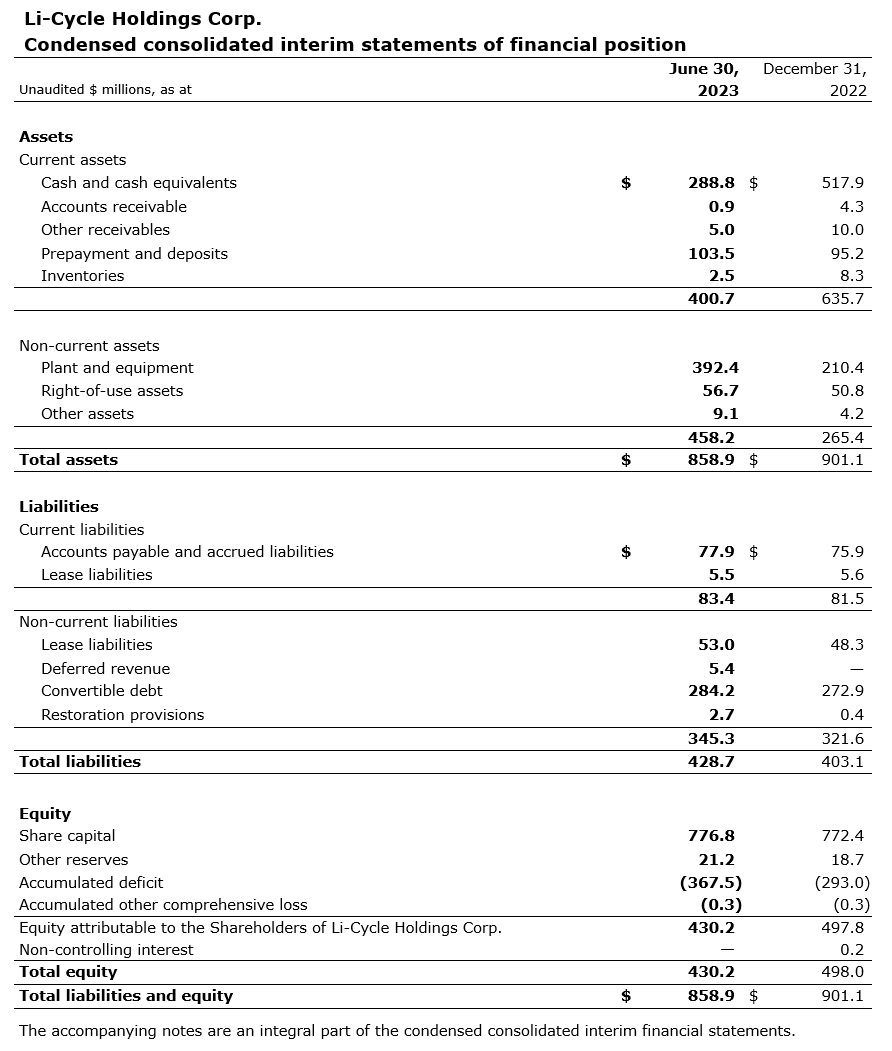

Balance Sheet Position

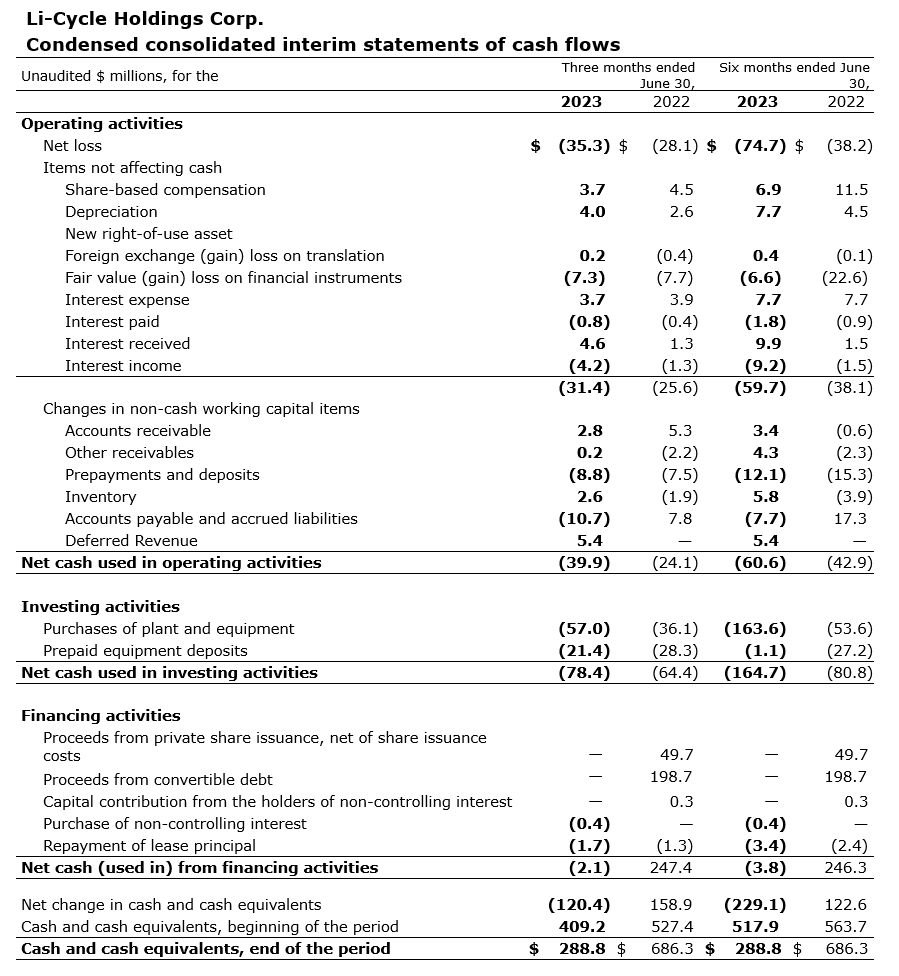

At June 30, 2023, Li-Cycle had cash on hand of $288.8 million. During the quarter, the Company’s capital spend was $78.4 million, primarily driven by the procurement of equipment and construction materials and services for the Rochester Hub.

On February 27, 2023, the Company entered into a conditional commitment with the DOE for a loan of up to $375 million through its Advanced Technology Vehicles Manufacturing Program, in support of the Rochester Hub development. The Company progressed the loan documentation to final stages and is currently on track to execute and close in September 2023.

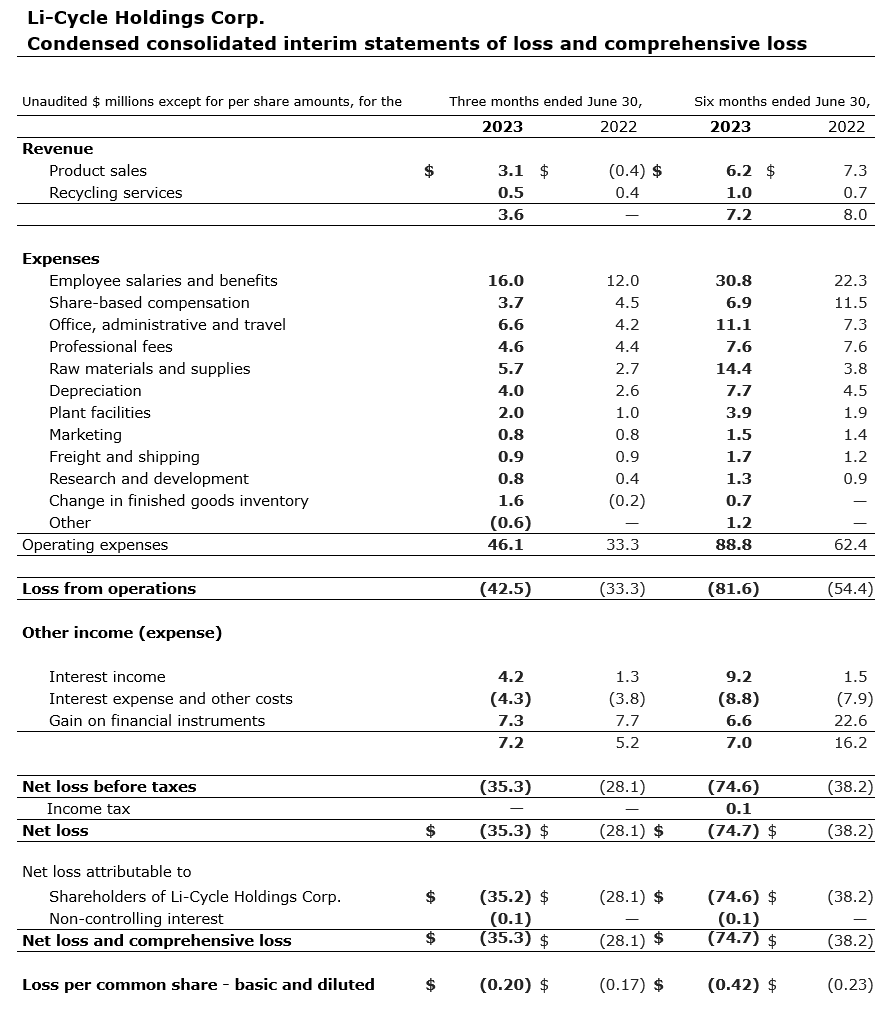

Financial Results for the Three Months Ended June 30, 2023

Revenues from product sales and recycling services before non-cash fair market value (FMV) adjustments were $5.5 million, which increased from $4.7 million in the same period of 2022. The increase in product revenue was primarily attributable to the higher sales volume, partially offset by a reduction in market prices of cobalt and nickel. Total revenues including FMV adjustments were $3.6 million, compared with nil last year, and included an unfavorable non-cash FMV impact of $1.9 million driven by a decline in cobalt and nickel prices versus an unfavorable FMV impact of $4.7 million last year.

Operating expenses increased to $46.1 million versus $33.3 million in the same period of 2022, driven primarily by higher raw material and supply costs coupled with higher average material costs. In addition, other expenses were higher due to growth in personnel related to the expansion of the Company’s global Spoke network and the construction of the Rochester Hub.

Net loss was $35.3 million, compared to $28.1 million in the same period of 2022, and included a fair value gain on financial instruments of $7.3 million and $7.7 million, respectively.

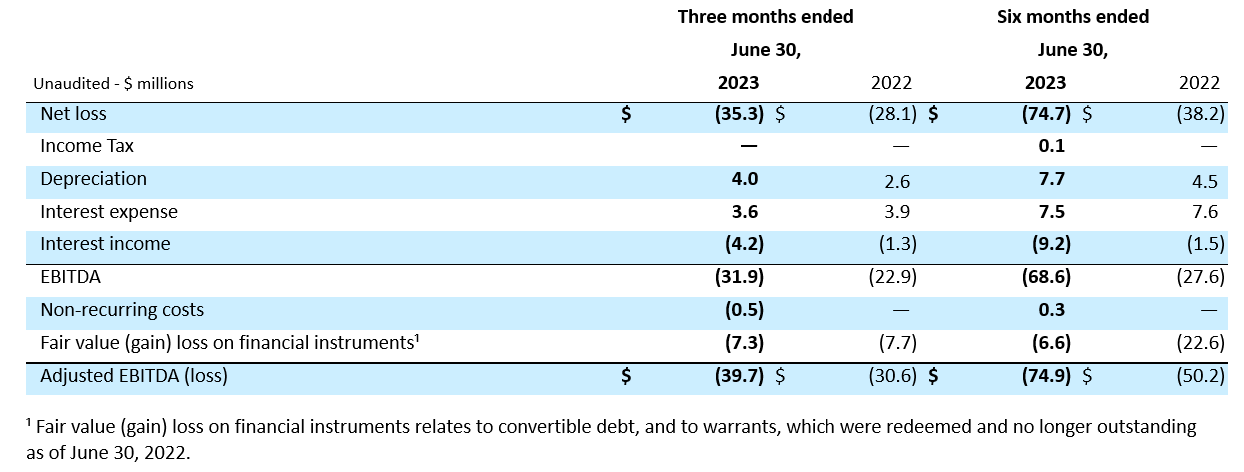

Adjusted EBITDA loss was $39.7 million, compared to a loss of $30.6 million in the same period of 2022, attributed to higher expenses relating to expansion of the global network, which more than offset increased revenue. Additionally, non-cash share-based compensation decreased to $3.7 million from $4.5 million in the same period of 2022.

Webcast and Conference Call Information

Company management will host a webcast and conference call on Monday, August 14, 2023, at 8:30 a.m. Eastern Time. The related presentation materials for the webcast and conference call will be made available on the Investor Relations section of the Li-Cycle website: https://investors.li-cycle.com/overview/default.aspx. Investors may listen to the conference call live via audio-only webcast or through the following dial-in numbers:

Domestic: (800) 579-2543

International: (203) 518-9814

Participant Code: LICYQ223

Webcast: https://investors.li-cycle.com

A replay of the conference call/webcast will also be made available on the Investor Relations section of the Company’s website at https://investors.li-cycle.com

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is a leading global lithium-ion battery resource recovery company and North America’s largest pure-play lithium-ion battery recycler, with a rapidly growing presence across Europe. Established in 2016, and with major customers and partners around the world, Li-Cycle is on a mission to recover critical battery-grade materials to create a domestic closed-loop battery supply chain for a clean energy future. The Company leverages its innovative, sustainable, and patent-protected Spoke & Hub Technologies™ to provide a safe, scalable, customer-centric solution to recycle all different types of lithium-ion batteries.

Our Spoke & Hub Technologies™ are based on a hydrometallurgical process that provides an environmentally friendly and cost-effective alternative to pyrometallurgical processing and traditional mining methods. At our Spokes, or pre-processing facilities, we recycle battery manufacturing scrap and end-of-life batteries to produce black mass, a powder-like substance which contains a number of valuable metals, including lithium, nickel, and cobalt. At our Hubs, or post-processing facilities, we will process black mass to produce critical battery-grade materials, including lithium carbonate, nickel sulphate, and cobalt sulphate. For more information, visit https://li-cycle.com/

Contacts

Investor Relations

Nahla A. Azmy

Sheldon D’souza

Media

Louie Diaz

Non-IFRS Financial Measures

Adjusted EBITDA (loss)

The table below reconciles adjusted EBITDA (loss) to net loss:

Li-Cycle reports its financial results in accordance with the International Financial Reporting Standards (“IFRS”). The Company makes references to certain non-IFRS measures, including adjusted EBITDA. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of the Company’s results of operations from management’s perspective. Accordingly, it should not be considered in isolation nor as a substitute for the analysis of the Company’s financial information reported under IFRS. Adjusted EBITDA is defined as earnings before depreciation and amortization, interest expense (income), income tax expense (recovery) adjusted for items that are not considered representative of ongoing operational activities of the business and items where the economic impact of the transactions will be reflected in earnings in future periods. Adjustments relate to fair value (gains) losses on financial instruments and certain non-recurring expenses. Foreign exchange (gain) loss is excluded from the calculation of Adjusted EBITDA.

Cautionary Notes – Forward-Looking Statements and Unaudited Results

Certain statements contained in this press release may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, Section 21 of the U.S. Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws. Forward-looking statements may generally be identified by the use of words such as “believe”, “may”, “will”, “continue”, “anticipate”, “intend”, “expect”, “should”, “would”, “could”, “plan”, “potential”, “future”, “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements in this press release include but are not limited to statements about: the expectation that Li-Cycle’s Spoke & Hub Network is on path to become a top global producer of key battery-grade materials and to produce up to 25,000 tonnes of lithium carbonate per year; the expectation that the Germany Spoke, Li-Cycle’s first in Europe, will become the largest pre-processing facility in Li-Cycle’s global Spoke network by the end of 2023; the expectation that the DFS with Glencore is on track for completion by mid-2024; the expectation that the Rochester Hub will commence commissioning in late 2023; the expectation that, when both the Rochester Hub and Portovesme Hub are in full operation, Li-Cycle will have total lithium carbonate production capacity of up to 25,000 tonnes per year, making Li-Cycle a top global and sustainable producer of lithium carbonate and key battery-grade materials; with projected Spoke pre-processing capacity of greater than 100,000 tonnes LIB equivalent and Hub post-processing capacity of 85,000 to 105,000 tonnes of black black mass, the expectation that Li-Cycle is on the path to become the leader in lithium-ion battery resource recovery and a top global and sustainable producer of lithium carbonate (up to 25,000 tonnes per year) and key battery materials (e.g., nickel and cobalt), particularly in North America and Europe; the expectation that, subject to a final investment decision, the development of the Portovesme Hub would proceed to construction, with commissioning expected to commence in late 2026 to early 2027; the expectation that, once operational, the Portovesme Hub would have an annual processing capacity of up to 70,000 tonnes per year of black mass, producing approximately 15,000 to 16,500 tonnes of lithium carbonate, as well as up to approximately 18,000 tonnes of nickel, and 2,250 tonnes of cobalt contained in MHP; the expectation that the Germany Spoke, when fully operational, will have a total annual processing capacity of up to 30,000 tonnes of LIB, including two lines of 10,000 tonnes each, in addition to ancillary processing capacity; the expectation that the second line of the Germany Spoke will be operationalized in late 2023; the expectations regarding the Company’s management of the construction labor as part of the Rochester Hub construction budget of $560 million; and the expectation that the DOE loan documentation is on track to be executed and closed in September 2023. These statements are based on various assumptions, whether or not identified in this communication, including but not limited to assumptions regarding the timing, scope and cost of Li-Cycle’s projects; the processing capacity and production of Li-Cycle’s facilities; Li-Cycle’s ability to source feedstock and manage supply chain risk; Li-Cycle’s ability to increase recycling capacity and efficiency; Li-Cycle’s ability to obtain financing on acceptable terms; Li-Cycle’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other business partners; general economic conditions; currency exchange and interest rates; compensation costs; and inflation. There can be no assurance that such estimates or assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of assisting readers in understanding certain key elements of Li-Cycle’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of Li-Cycle’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes and is not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and are not guarantees of future performance. Li-Cycle believes that these risks and uncertainties include, but are not limited to, the following: Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries; Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all; Li-Cycle’s inability to manage future global growth effectively; Li-Cycle’s inability to develop the Rochester Hub, and other future projects including its Spoke network expansion projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products; Li-Cycle’s failure to materially increase recycling capacity and efficiency; Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful; one or more of Li-Cycle’s current or future facilities becoming inoperative, capacity constrained or if its operations are disrupted; additional funds required to meet Li-Cycle’s capital requirements in the future not being available to Li-Cycle on acceptable terms or at all when it needs them; Li-Cycle expects to continue to incur significant expenses and may not achieve or sustain profitability; problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as securing new customers and off-take agreements; a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies; decreases in benchmark prices for the metals contained in Li-Cycle’s products; changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities; the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives; Li-Cycle’s revenues for the Rochester Hub are derived significantly from a single customer; Li-Cycle’s insurance may not cover all liabilities and damages; Li-Cycle’s heavy reliance on the experience and expertise of its management; Li-Cycle’s reliance on third-party consultants for its regulatory compliance; Li-Cycle’s inability to complete its recycling processes as quickly as customers may require; Li-Cycle’s inability to compete successfully; increases in income tax rates, changes in income tax laws or disagreements with tax authorities; significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors; fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings; unfavorable economic conditions, such as consequences of the global COVID-19 pandemic; natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events; failure to protect or enforce Li-Cycle’s intellectual property; Li-Cycle may be subject to intellectual property rights claims by third parties; Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or if it fails to develop and maintain a proper and effective internal control over financial reporting. These and other risks and uncertainties related to Li-Cycle’s business are described in greater detail in the section entitled “Risk Factors” and “Key Factors Affecting Li-Cycle’s Performance” in its Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission and the Ontario Securities Commission in Canada. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statement.

Li-Cycle assumes no obligation to update or revise any forward-looking statements, except as required by applicable laws. These forward-looking statements should not be relied upon as representing Li-Cycle’s assessments as of any date subsequent to the date of this press release.