June 14, 2022

June 14, 2022

Original press release deployed via Business Wire

TORONTO–Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the “Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, today announced financial results for its second quarter ended April 30, 2022. Revenues increased to $8.7 million from $0.3 million in the second quarter of fiscal year 2021.

“We continued to successfully implement our Spoke & Hub network strategy, with significant operational, commercial, and financial achievements this quarter. The Arizona Spoke is now on-line, doubling our current Spoke capacity and a testament to our modular construction approach. We believe this approach is replicable and scalable for our future Spokes. Additionally, we made continued contracting and execution strides at the Rochester Hub, which remains on target for commissioning in 2023,” said Ajay Kochhar, Li-Cycle President and Chief Executive Officer.

“Strategically, we are positioning Li-Cycle as a leading and preferred recycler and supplier of critical battery materials, capitalizing on the significant secular growth trends. We executed long-term in-take and off-take commercial agreements with Glencore plc, a leading battery metals provider, and LG Chem, Inc. (“LG Chem”) and LG Energy Solution, Inc. (“LGES” and, together with LG Chem, “LG”), leading global electric battery manufacturers. This collaborative approach provides customers with a global and vertically integrated solution, which we believe places Li-Cycle at the center of the battery supply chain loop in North America and Europe,” added Kochhar. “Finally, these strategic commercial partnership arrangements were combined with total investment of $250 million in Li-Cycle, further enhancing our balance sheet and enabling additional financial flexibility.”

Second Quarter Financial Results

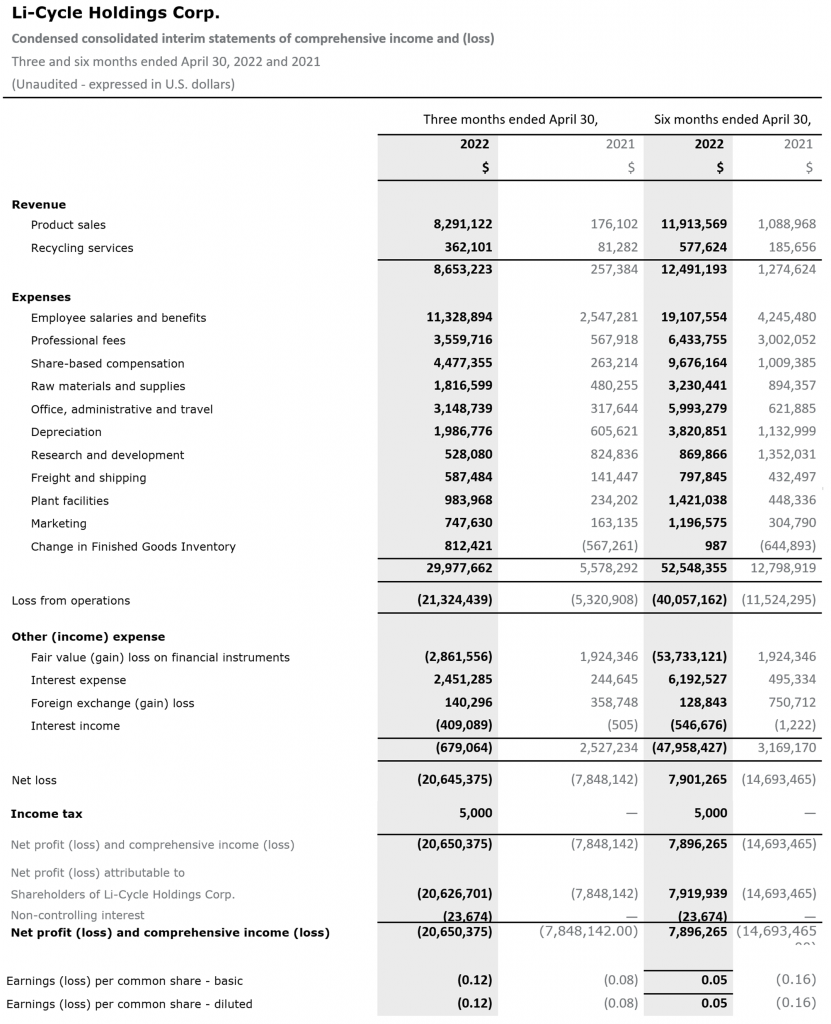

Revenues for the quarter ended April 30, 2022 increased to $8.7 million, compared to $0.3 million in the same quarter last year, driven by increases in product sales volume and metal-based prices.

Operating expenses for the quarter increased to $30.0 million, compared to $5.6 million during the same period last year, reflecting the ongoing expansion of operations in North America and the early build out in Europe. This increase was primarily related to personnel costs for operational, corporate, commercial, and engineering resources as well as professional fees and administrative costs in support of becoming a public company. In addition, higher costs from raw materials and supplies are attributable to increased black mass production.

Net loss for the quarter was approximately $20.7 million, compared to a net loss of approximately $7.8 million in the prior-year period. This loss included $2.9 million of fair value gains on financial instruments.

Adjusted EBITDA1 loss for the quarter was $19.5 million, compared to $5.1 million for the prior-year period. This was largely driven by the increase in the operating expenses as discussed above, directly related to the growth and expansion of the business. In addition, non-cash stock-based compensation increased to $4.5 million as compared to $0.3 million in 2021.

New Battery Supply Commercial Partnerships

Li-Cycle recently achieved significant commercial milestones, entering into long-term agreements with two leading global strategic partners in the battery material supply chain, thereby closing the loop for key lithium-ion battery materials. Both LG and Glencore designated Li-Cycle as a preferred lithium-ion battery recycling partner. These new partnerships complement Li-Cycle’s existing commercial agreements with Traxys North America Inc. and others.

The Glencore agreements are global in a nature, with a focus primarily on North America and Europe. Glencore will supply battery feedstock for Li-Cycle’s Spokes, as well as both black mass and sulfuric acid for Li-Cycle’s Hubs. Glencore also will provide off-take and marketing of Li-Cycle’s battery-grade end products and certain by-products produced at the Company’s Spokes & Hubs.

The LG agreements are focused on North America. LGES will provide Li-Cycle’s Spokes with nickel-bearing lithium-ion battery scrap and other lithium-ion battery recycling material. Additionally, Li-Cycle will supply LG with nickel sulphate to be produced at Li-Cycle’s Rochester Hub, once operational.

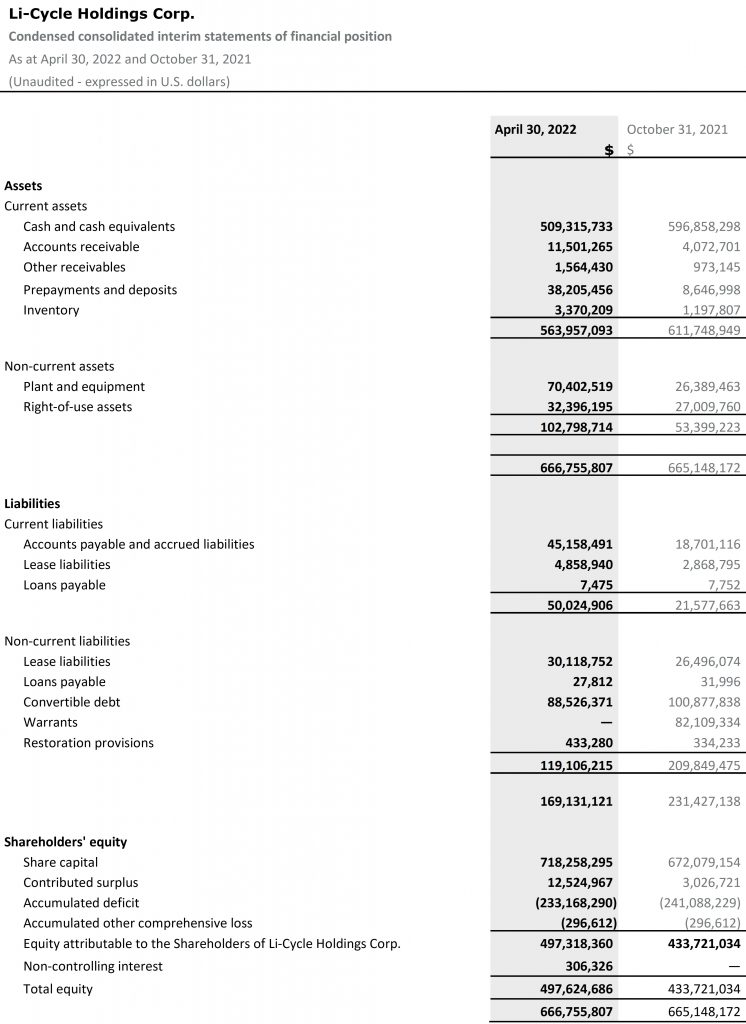

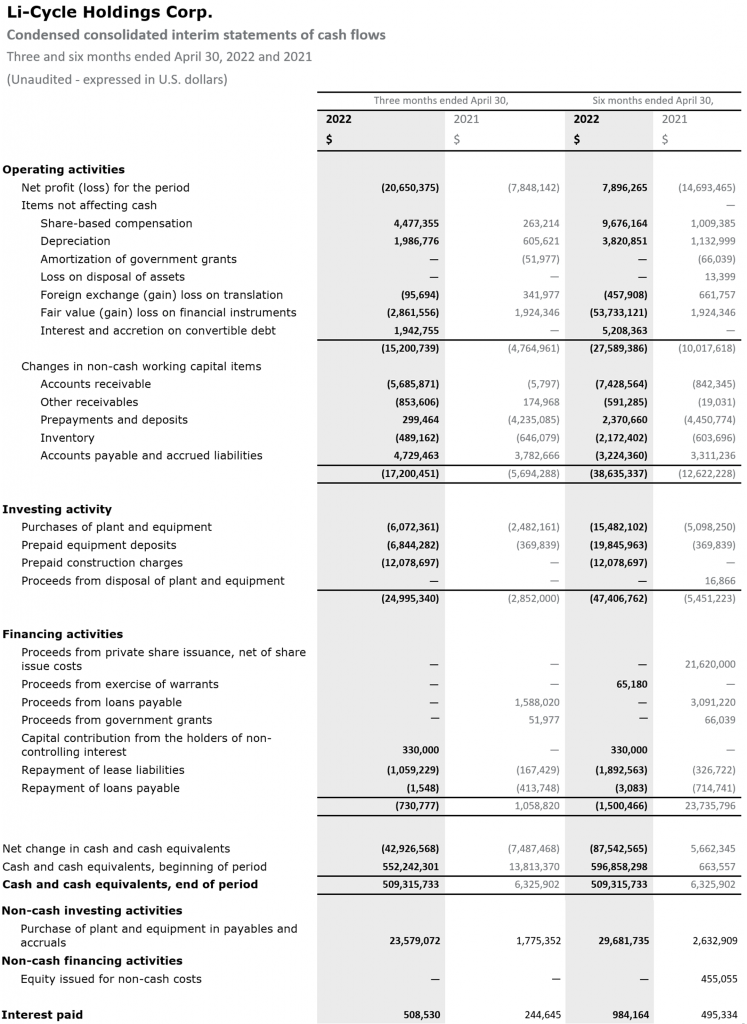

Funding Update and Balance Sheet Position

Li-Cycle ended its second quarter with $509.3 million cash on hand. The Company further enhanced its balance sheet with additional investment proceeds of $250 million, received upon completion of the commercial agreements in May and June 2022 from LG and Glencore, respectively. Including the investment proceeds, the Company’s pro-forma cash balance is approximately $760 million.

As a result, the Company has sufficient liquidity for capital and operating needs to fund its current pipeline of projects in development.

Webcast and Conference Call Information

Company management will host a webcast and conference call on Tuesday, June 14, 2022, at 8:30 a.m. Eastern Time. The related presentation materials for the webcast and conference call will be made available on the investor section of the Li-Cycle website: https://investors.li-cycle.com/overview/default.aspx

Investors may listen to the conference call live via audio-only webcast or through the following dial-in numbers:

Domestic: (800) 909-5202

International: (785) 830-1914

Participant Code: LICYQ222

Webcast: https://investors.li-cycle.com

A replay of the conference call/webcast will also be made available on the Investor Relations section of the Company’s website at https://investors.li-cycle.com.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

Non-IFRS Financial Measures

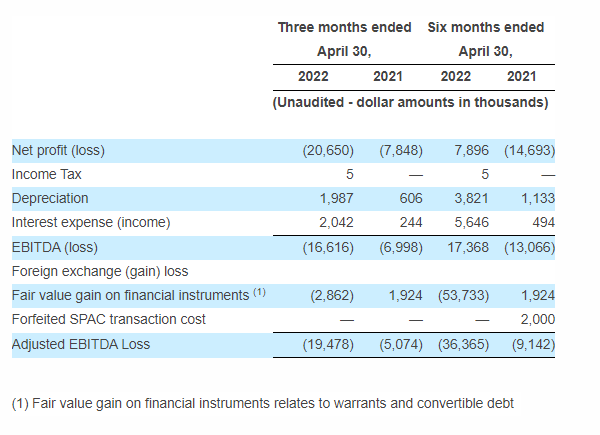

Adjusted EBITDA (loss)

The table below reconciles Adjusted EBITDA (loss) to net profit (loss):

Li-Cycle reports its financial results in accordance with the International Financial Reporting Standards (“IFRS”). The Company makes references to certain non-IFRS measures, including Adjusted EBITDA. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for the analysis of the Company’s financial information reported under IFRS. Li-Cycle defines Adjusted EBITDA as earnings before depreciation and amortization, interest expense (income), income tax expense (recovery), foreign exchange (gain) loss, fair value (gain) loss on financial instruments, and non-recurring expenses such as forfeited SPAC transaction cost, and listing fee related to the business combination that resulted in Li-Cycle becoming a public company.

Forward-Looking Statements

Certain statements contained in this communication may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the U.S. Securities Act of 1933, as amended, Section 21 of the U.S. Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws. Forward-looking statements may generally be identified by the use of words such as “will”, “continue”, “anticipate”, “expect”, “would”, “could”, “plan”, “future” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements in this press release include but are not limited to Li-Cycle’s ability to capitalize on growth opportunities; the annual input capacity and production output of the Rochester Hub, its expected start-up date and total capital cost; statements about the anticipated benefits from the proposed collaboration with Glencore and LG, including pursuant to the commercial agreements entered into between Li-Cycle and each of Glencore and LG; the ability of Li-Cycle and Glencore to build localized supply chains for both primary and recycled sources of key battery materials to drive sustainable global electrification and better serve their customers; the annual processing capacity of the Arizona, Alabama, Ohio, Norway and Germany Spokes and the timing of commencement of their operations; our target to meet or exceed black mass production of 6,500 to 7,500 tonnes during fiscal year 2022. These statements are based on various assumptions, whether or not identified in this communication, which Li-Cycle believe are reasonable in the circumstances. There can be no assurance that such estimates or assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of assisting readers in understanding certain key elements of Li-Cycle’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of Li-Cycle’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes and is not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and are not guarantees of future performance. Li-Cycle believes that these risks and uncertainties include, but are not limited to, the following: Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries; Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all; Li-Cycle’s inability to manage future global growth effectively; Li-Cycle’s inability to develop the Rochester Hub, Arizona Spoke, Alabama Spoke and other future projects including its Ohio, Norway and Germany Spoke projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products; Li-Cycle’s failure to materially increase recycling capacity and efficiency; Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful; one or more of Li-Cycle’s current or future facilities becoming inoperative, capacity constrained or if its operations are disrupted; additional funds required to meet Li-Cycle’s capital requirements in the future not being available to Li-Cycle on commercially reasonable terms or at all when it needs them; Li-Cycle expects to incur significant expenses and may not achieve or sustain profitability; problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as securing new customers and off-take agreements; a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies; decreases in benchmark prices for the metals contained in Li-Cycle’s products; changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities; the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives; Li-Cycle’s revenues for the Rochester Hub are derived significantly from a single customer; Li-Cycle’s insurance may not cover all liabilities and damages; Li-Cycle’s heavy reliance on the experience and expertise of its management; Li-Cycle’s reliance on third-party consultants for its regulatory compliance; Li-Cycle’s inability to complete its recycling processes as quickly as customers may require; Li-Cycle’s inability to compete successfully; increases in income tax rates, changes in income tax laws or disagreements with tax authorities; significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors; fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings; unfavourable economic conditions, such as consequences of the global COVID-19 pandemic; natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, cyber incidents, boycotts and geo-political events; failure to protect or enforce Li-Cycle’s intellectual property; Li-Cycle may be subject to intellectual property rights claims by third parties; Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or if it fails to develop and maintain a proper and effective internal control over financial reporting. These and other risks and uncertainties related to Li-Cycle’s business are described in greater detail in the section entitled “Risk Factors” in its Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission and the Ontario Securities Commission in Canada on January 31, 2022. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statement.

____________________________

1 Adjusted EBITDA is not a recognized measure under IFRS. See Non-IFRS Financial Measures section of this press release, including for a reconciliation of Adjusted EBITDA to net profit (loss).

Nahla Azmy

Investors: [email protected]

Kunal Phalpher

Media: [email protected]