February 23, 2021

February 17, 2021 – Gold Panda

Electric vehicles (EVs) are often criticized for not being really green as some of the metals used in lithium-ion batteries such as lithium and cobalt require the opening of many new mines. On the other hand, if you’re an investor interested in battery metals, mines can be messy. I’ve been covering the mining sector on SA for almost four years and I can tell you that cost overruns, technical issues and poor production and financial figures are a common.

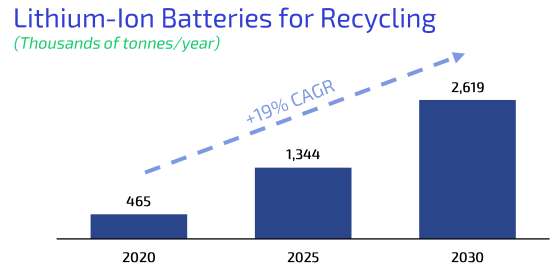

Recycling companies can avoid many of the challenges of mines and they don’t harm the environment. Also, with EV sales projected to soar over the next several years, the number of lithium-ion batteries that need to be recycled will grow at a rapid pace.

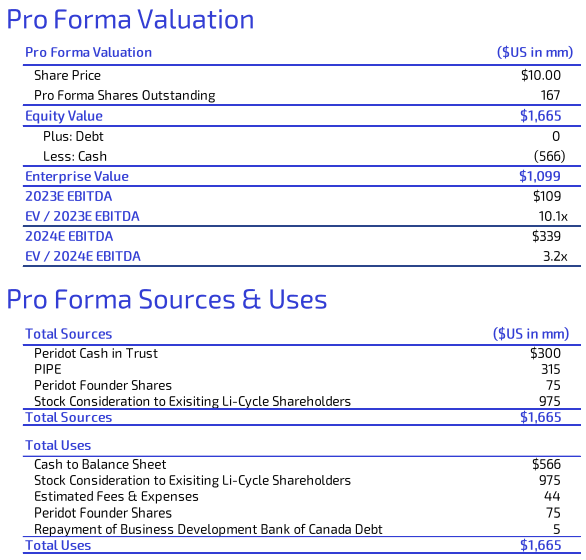

And this is where Li-Cycle comes in. The latter claims to be the largest recycler of lithium-ion batteries in North America and is merging with a special purpose acquisition (SPAC) vehicle called Peridot Acquisition Corp. (NYSE:PDAC) in a deal valuing it at $1.67 billion.

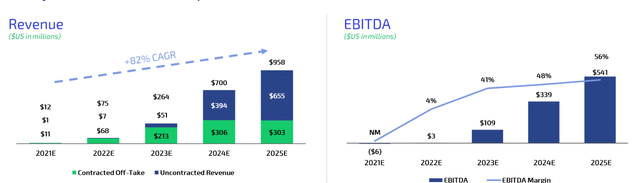

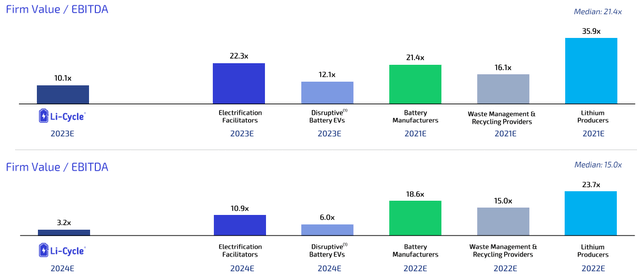

SPAC deals usually have elevated prices, but with a projected EV/EBITDA multiple of 3.2x based on 2024 projections, I think this one is a buy.

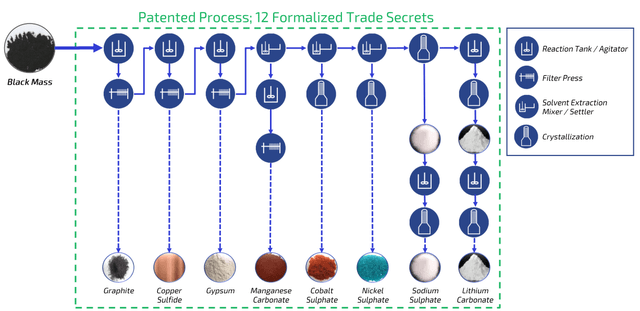

Li-Cycle was founded in 2016 and specializes in the recovery of materials from battery manufacturing scrap and end-of-life batteries, including lithium, cobalt, nickel and manganese products. It has developed a patented process with 12 formalized trade secrets that use standard equipment.

(Source: Peridot)

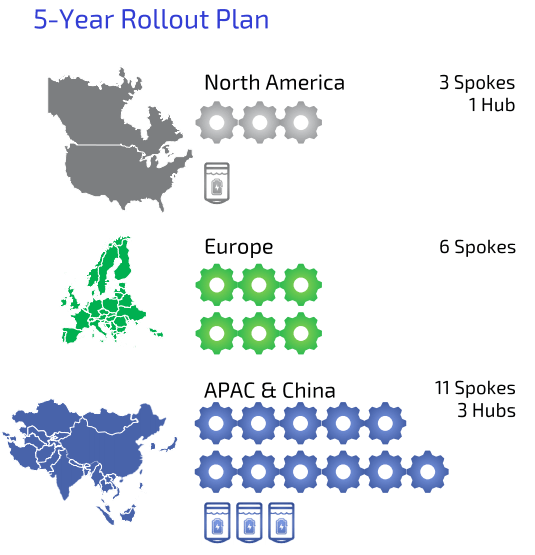

(Source: Peridot)

The company claims that its technology can deliver a recycling efficiency rate of up to 95%, which I think is excellent, considering smelting of lithium-ion batteries usually has an efficiency of less than 50%.

Li-Cycle currently has over 40 commercial contracts and off-take agreements through 2030, and among its partners are the world’s largest global automotive and battery makers.

The company currently has two operating facilities with a combined capacity of 10,000 t/y and plans to grow its capacity by over 30 times in the next five years to become a global leader.

(Source: Peridot)

Looking at the financials, I think it’s justified to call Li-Cycle a startup considering 2021 revenues are projected to come in at just $12 million. However, the sector is growing fast and so is the company and 2025 revenues and EBITDA are expected to reach $958 million and $541 million, respectively.

(Source: Peridot)

(Source: Peridot)

The margins of the business look great in my opinion, with each so called spoke expected to generate an after-tax internal rate of return (IRR) of around 67%. Hubs, in turn, are projected to deliver IRR of some 60%.

(Source: Peridot)

The capex required over the next five years is significant and it stands at $985 million. However, the company can finance a large part of it thanks to its SPAC deal with Peridot.

The merger will provide Li-Cycle with some $615 million in additional funding, with Peridot giving it $300 million. The remainder will come from a private investment in public equity (PIPE) transaction. When all is said and done, Li-Cycle will have $566 million in the bank.

(Source: Peridot)

As you can see, the enterprise value is $1.1 billion at $10 per share, which may seem a bit much for a company with almost no revenues. However, I think Li-Cycle looks undervalued compared to many companies in the lithium-ion batteries if it can achieve its growth objectives. (Source: Peridot)

(Source: Peridot)

Li-Cycle is an interesting company in a segment which is projected to grow fast. However, I can think of several factors that could derail the bull thesis.

1) The future of lithium-ion batteries

There is no guarantee that this type of battery will retain its market share in the future. For example, there are several companies focusing on fuel cells and Toyota (NYSE:TM) plans to launch a revolutionary solid-state battery this year.

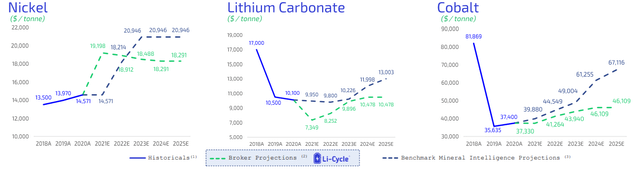

2) Prices of battery metals

While the revenue and EBITDA projections of Li-Cycle are impressive, it has to be noted that the company is forecasting pretty high prices for nickel, lithium carbonate and cobalt over the next few years.

(Source: Peridot)

(Source: Peridot)

If prices of these products stay at today’s levels or decrease, the financials of Li-Cycle will be disappointing in 2024 and 2025.

3) Technical issues

Scaling up is never easy and technical issues are common. In fact, I’ve been a shareholder in a somewhat similar company. Back in 2015, I invested a small amount in a lead-acid batteries recycling startup called Aqua Metals (NASDAQ:AQMS). It had an award-winning and revolutionary technology just like Li-Cycle and the financials also looked great. The theory was that a single plant capex of $29 million could deliver close to $15 million in annual EBIT. Various technical setbacks and five years later and Aqua Metals has quarterly product sales of less than $0.1 million.

4) Funding

Li-Cycle will have $566 million in the bank, but this is still short of the $985 million required for capex over the next few years. There is no guarantee that the company can obtain additional funding and going the share issue route could result in significant dilution for investors.

Li-Cycle aims to become the leading recycler of lithium-ion batteries in the world and the financial projections look compelling. The business is valued at 3.2x EV/EBITDA based on 2024 projections, which looks cheap.

Keep in mind though that this is a high risk/high reward type of investment opportunity. The company’s goals are ambitious but a lot can go wrong. Overall, I think this one is a buy, but a somewhat speculative one that relies on a bright future for lithium-ion batteries.