September 9, 2021

Rochester Hub and Arizona Spoke Continue to be on Track

Li-Cycle will Add a Fourth Spoke in Alabama to Meet Demand; Pace of New Battery Mega-factory Deployment Far Exceeding Expectations

Li-Cycle Reports Third Quarter Revenue Increasing 840% Year-Over-Year to $1.7 Million

Subsequent to Fiscal Q3 2021, Li-Cycle Successfully Completed its Public Listing in August 2021, Resulting in Net Proceeds of $527 Million

September 9, 2021

Original article published in Businesswire

TORONTO, ONTARIO (September 9, 2021) – Li-Cycle Holdings Corp. (NYSE: LICY) (“Li-Cycle” or the “Company”), an industry leader in lithium-ion battery resource recovery and the leading lithium-ion battery recycler in North America, today announced financial results for its third quarter ended July 31, 2021.

Founded in 2016, Li-Cycle utilizes its patented Spoke & Hub Technologies™ to achieve industry-leading resource recovery rates and produce the critical battery materials underpinning the global growth in electric vehicle (“EV”) proliferation. The imperative for economically and environmentally sustainable resource recycling is growing in lockstep with the exponential growth of battery manufacturing with an average of 5% to 10% of new battery production being rejected/scrapped. Li-Cycle’s two-stage battery recycling model enables customers to benefit from an economically sustainable, safe and environmentally friendly solution for the recycling of all types of lithium-ion materials.

“I am incredibly proud of what the Li-Cycle team has accomplished so far in 2021, continuing our mission to solve the global battery manufacturing scrap and end-of-life lithium-ion battery problem by creating a secondary supply of critical battery materials, while also ensuring a sustainable future for our planet. Since announcing our business combination with Peridot Acquisition Corp. in February, we signed significant commercial agreements with Ultium Cells LLC (the joint venture between General Motors and LG Energy Solution) and Univar Solutions Inc.; we began construction of our Arizona Spoke; and just yesterday, we announced plans to build an incremental fourth Spoke in Alabama. With the funds from our business combination transaction completed in August 2021, we believe that Li-Cycle is primed to capitalize on the significant growth opportunities created by the continuing mobility revolution,” said Ajay Kochhar, President and Chief Executive Officer of Li-Cycle.

Key Fiscal Q3 2021 Highlights

Spoke and Hub Roll-out Plans Responding to Increasing Market Demand

Demand for lithium-ion battery recycling has continued to exceed the Company’s projections and, in order to meet this growing demand, Li-Cycle plans to increase and accelerate its investment in the build-out of the Company’s recycling capacity. In addition to the Arizona Spoke project, Li-Cycle has announced the development of the Alabama Spoke, increasing its North American processing capacity beyond that of previous plans and projections. The Company is confident in its ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025 (measured as tonnes of lithium-ion battery equivalent input per year). The Company expects to provide fiscal year 2022 guidance in conjunction with the reporting of full fiscal year 2021 results.

Commercial highlights

Fourteen additional battery supply customers were onboarded during fiscal Q3 2021, bringing Li-Cycle’s battery supply customer base to a new total of over 70. This demonstrates continued Li-Cycle technical and commercial validation, alongside continued market acceleration. New battery supply customers include the following (as previously announced):

Hub capital project execution highlights

Spoke expansion highlights

Spoke operations highlights – Kingston Spoke and Rochester Spoke

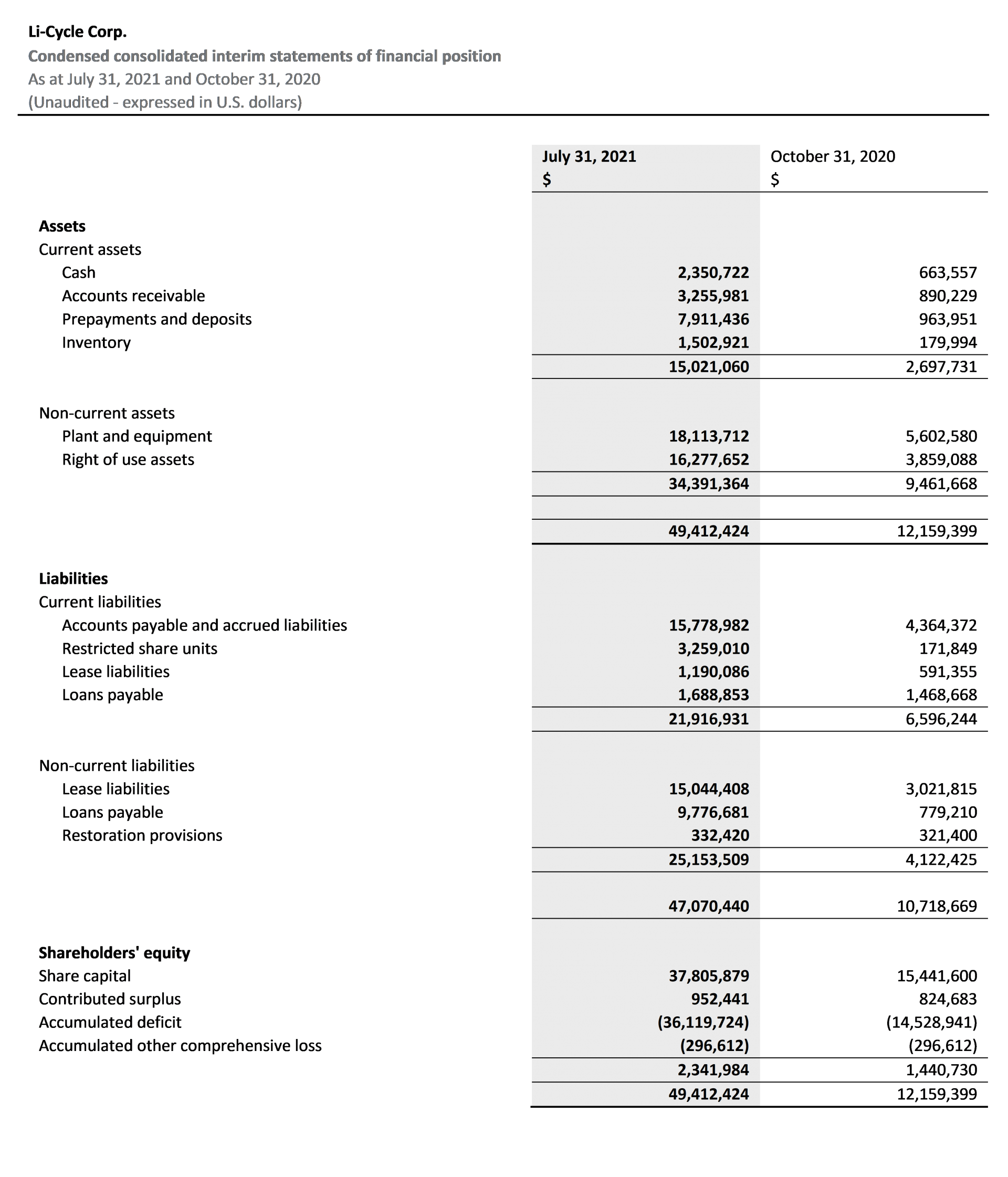

Financial Results for Third Quarter 2021

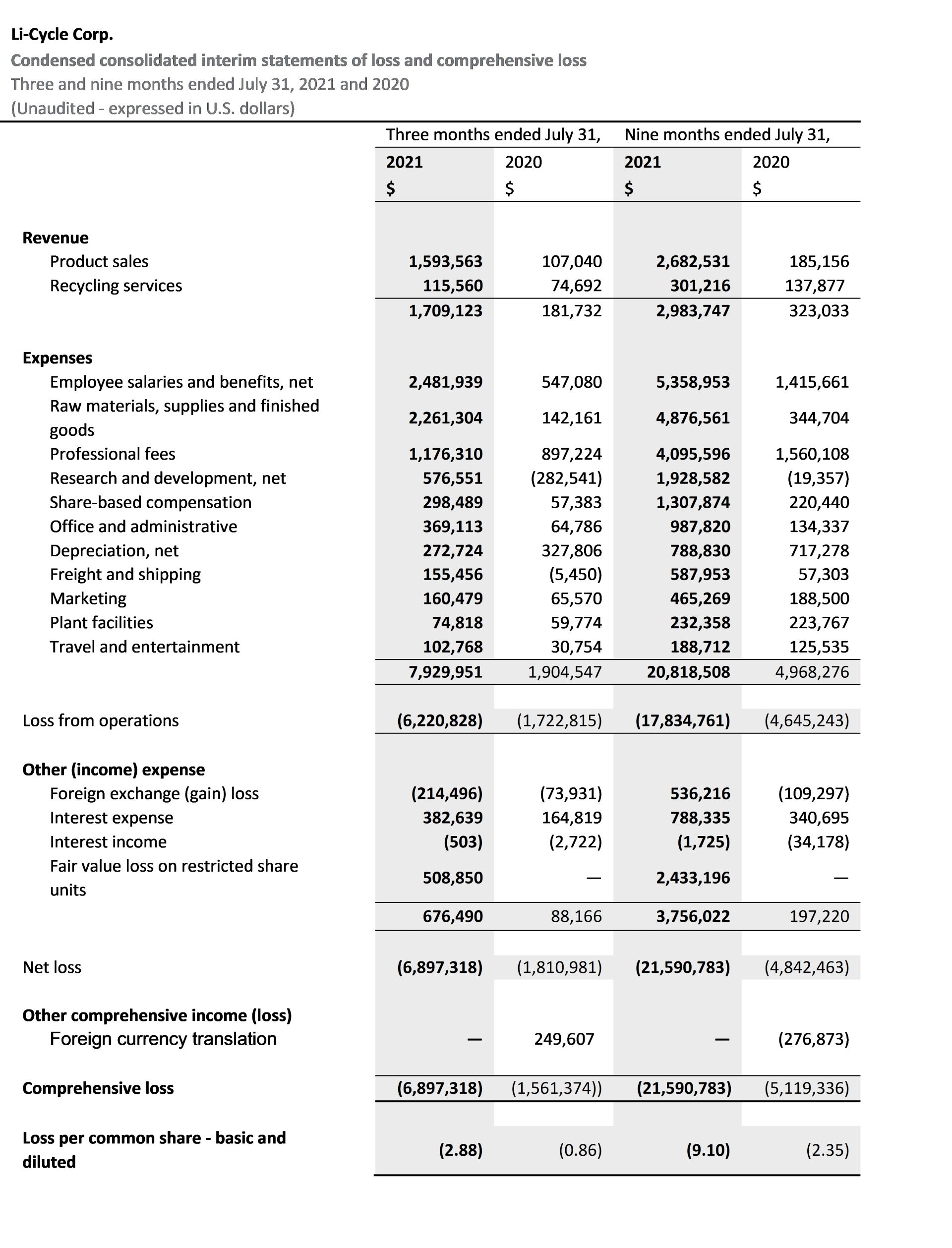

Revenues grew 840% to $1.7 million, compared to $0.2 million in the prior-year period, driven by increases in recycling services and product sales, primarily as a result of the increase in the quantities of batteries and battery scrap processed at the Rochester Spoke and the continued onboarding of new battery supply customers. Revenues from product sales were approximately $1.6 million, while revenues from recycling services were approximately $0.1 million.

Operating expenses increased to $7.9 million, compared to $1.9 million during the prior-year period driven by increased personnel costs, a ramp-up of operations at the Kingston and Rochester Spokes, increases in raw materials and supplies, increased R&D spending, and non-recurring expenses related to the business combination between Li-Cycle and Peridot Acquisition Corp. completed in August 2021 (the “Business Combination”). The year-over-year changes in R&D expenditures were primarily due to the fact that R&D expenses in 2020 were largely funded by government grants, the amortization of which offset the applicable R&D expense for accounting purposes.

Net loss was approximately $6.9 million, compared to approximately $1.8 million in the prior-year period.

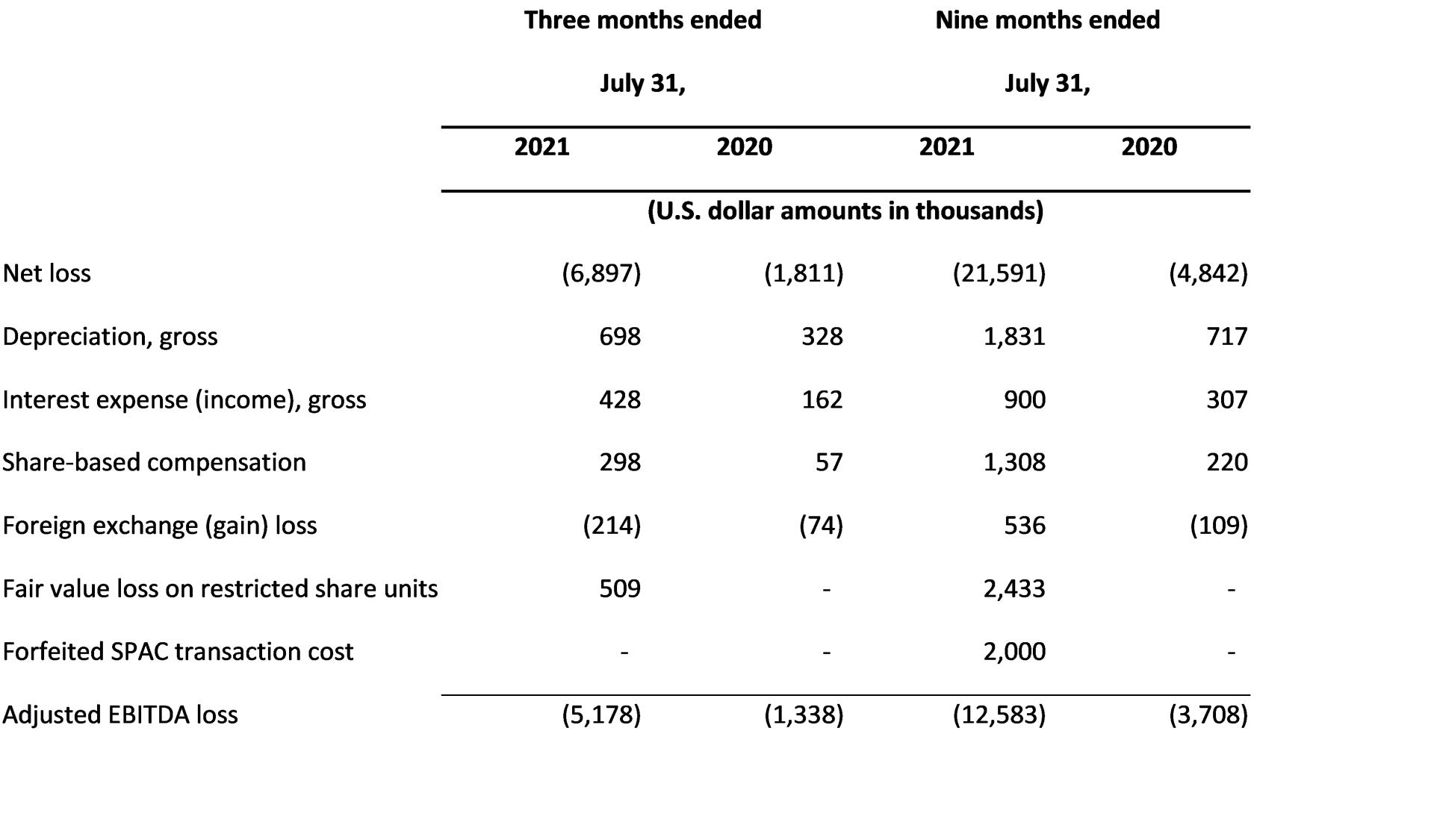

Adjusted EBITDA (loss) was $(5.2) million, compared to $(1.3) million for the prior-year period[1].

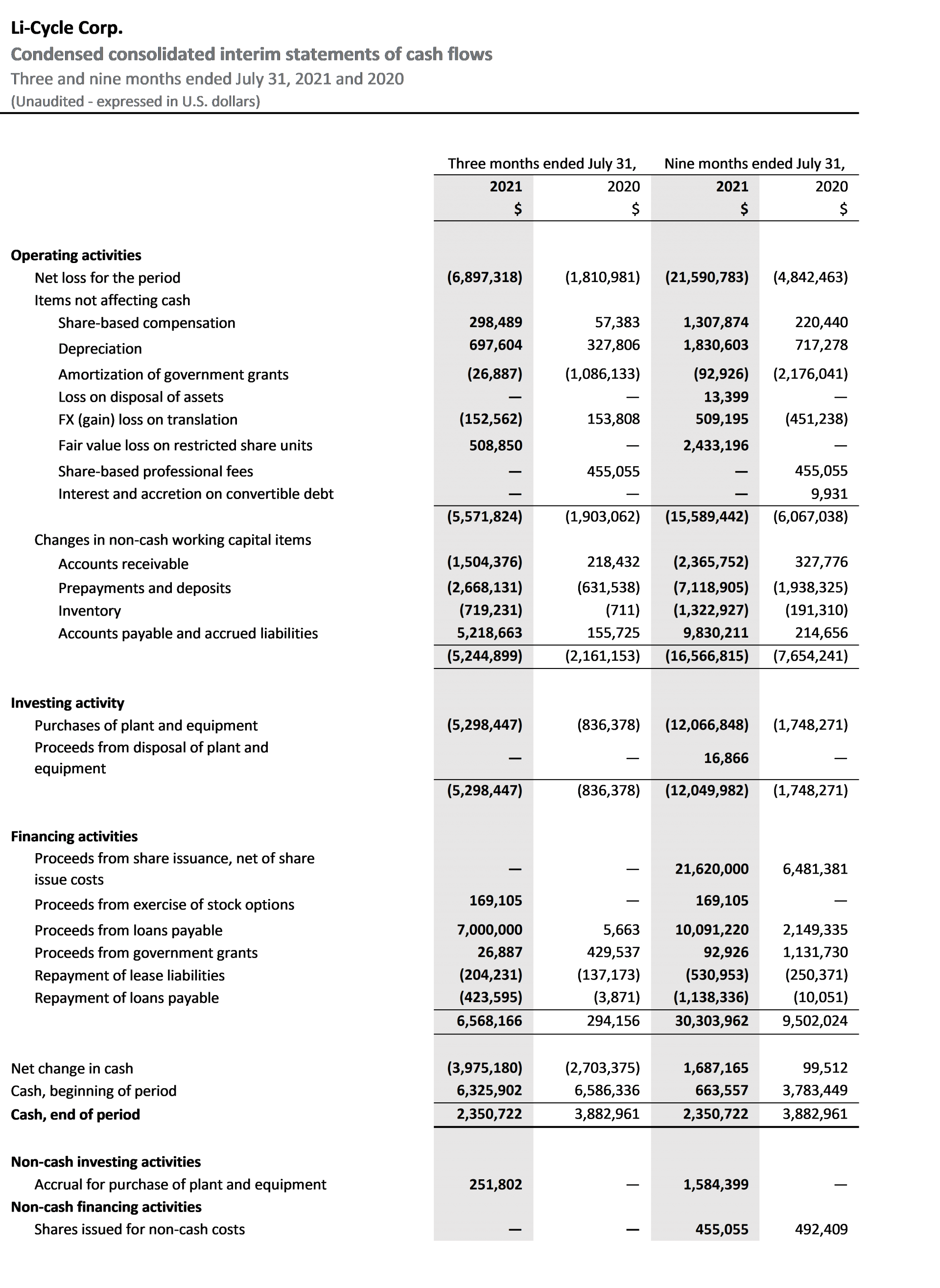

Cash flows used in operating activities were approximately $5.2 million, compared to $2.2 million during the prior-year period, primarily driven by increased personnel costs, a ramp up of operations at the Kingston Spoke and Rochester Spoke, increases in raw materials, supplies and finished goods, increased R&D spending, and consulting costs relating to the development of the Rochester Hub. Cash, cash equivalents and marketable securities were approximately $2.4 million as of July 31, 2021. Subsequent to quarter end, Li-Cycle completed the Business Combination, resulting in net proceeds of $527 million.

Shares outstanding as of August 31, 2021 were 163,179,553 common shares.

Financial Results for the Nine Months Ended July 31, 2021

Revenues grew approximately 824% to approximately $3.0 million, compared to approximately $0.3 million in the prior-year period, driven by increases in recycling services and product sales, primarily as a result of the increase in the quantities of batteries and battery scrap processed at the Kingston and Rochester Spokes and the continued onboarding of new battery supply customers. Revenues from product sales were approximately $2.7 million, while revenues from recycling services were approximately $0.3 million for the nine-month period ended July 31, 2021.

Operating expenses increased to approximately $20.8 million, compared to approximately $5.0 million during the prior-year period, driven by increased personnel costs, a ramp up of operations at the Kingston and Rochester Spokes, increases in raw materials, supplies and finished goods, increased R&D spending, and non-recurring expenses related to the Business Combination. The year-over-year changes in R&D expenditure were primarily due to the fact that R&D expenses in 2020 were largely funded by government grants, the amortization of which offset the applicable R&D expense for accounting purposes.

Net loss was approximately $21.6 million, compared to approximately $4.8 million in the prior-year period.

Adjusted EBITDA (loss) was approximately $(12.6) million for the first nine months of 2021, compared to approximately $(3.7) million for the prior-year period.

Cash flows used in operating activities were approximately $16.6 million, compared to approximately $7.7 million during the prior-year period, primarily driven by increased personnel costs, a ramp up of operations at the Kingston Spoke and Rochester Spoke, increases in raw materials and supplies, increased R&D spending, and consulting costs relating to the development of the Rochester Hub.

Fiscal Year 2021 Outlook and Previously Disclosed Projections

Li-Cycle’s fiscal year 2021 business outlook is provided as follows:

Li-Cycle included certain projected financial information in the F-4/proxy statement initially filed with the SEC on July 15, 2021 in connection with the Business Combination (as amended, the Proxy/Registration Statement).

As highlighted above, demand for lithium-ion battery recycling has continued to exceed the Company’s projections. In order to meet this growing demand, the Company plans to increase and accelerate investment in the build-out of its recycling capacity, including through the development of the Alabama Spoke, increasing its processing capacity beyond that of previous plans and projections. As a result of such developments, the assumptions underlying the projections included in the Proxy/Registration Statement, including a number regarding capital expenditures and the timing of the roll-out of new facilities, no longer reflect a reasonable basis on which to project Li-Cycle’s future results and therefore such projections should not be relied on as indicative of future results. The Company’s actual results could differ materially relative to the projected financial information contained in the Proxy/Registration Statement. The Company is confident in its ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025 (measured as tonnes of lithium-ion battery equivalent input per year). As noted within this press release, the Company expects to provide fiscal year 2022 guidance in conjunction with the reporting of full fiscal year 2021 results.

Webcast and Conference Call Information

Company management will host a webcast and conference call on September 9, 2021, at 9:00 a.m. Eastern Time, to discuss the Company’s financial results.

Interested investors and other parties can listen to a webcast of the live conference call and access the Company’s first quarter update presentation by logging onto the Investor Relations section of the Company’s website at https://investors.li-cycle.com/.

The conference call can be accessed live over the phone by dialing 1-877-407-0784 (domestic) or + 1-201-689-8560 (international). A telephonic replay will be available approximately two hours after the call by dialing 1-844-512-2921 (domestic) or +1-412-317-6671 (international). The conference ID for the live call and pin number for the replay is 13722615. The replay will be available until 11:59 p.m. Eastern Time on September 21, 2021.

About Li-Cycle Holdings Corp.

Li-Cycle (NYSE: LICY) is on a mission to leverage its innovative Spoke & Hub Technologies™ to provide a customer-centric, end-of-life solution for lithium-ion batteries, while creating a secondary supply of critical battery materials. Lithium-ion rechargeable batteries are increasingly powering our world in automotive, energy storage, consumer electronics, and other industrial and household applications. The world needs improved technology and supply chain innovations to better manage battery manufacturing waste and end-of-life batteries and to meet the rapidly growing demand for critical and scarce battery-grade raw materials through a closed-loop solution. For more information, visit https://li-cycle.com/.

Contacts:

Investors: [email protected]

Media: [email protected]

[1] Adjusted EBITDA is not a recognized measure under IFRS, does not have a standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other companies. See “Non-IFRS Financial Measures” section of this press release, including for a reconciliation of Adjusted EBITDA to net loss.

Li-Cycle reports its financial results in accordance with the International Financial Reporting Standards (“IFRS”). The Company makes references to certain non-IFRS measures, including Adjusted EBITDA. These measures are not recognized measures under IFRS, do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing a further understanding of the Company’s results of operations from management’s perspective. Accordingly, they should not be considered in isolation nor as a substitute for the analysis of the Company’s financial information reported under IFRS.

Forward-Looking Statements

Certain statements contained in this communication may be considered “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1993, as amended, Section 21 of the Securities Exchange Act of 1934, as amended, and applicable Canadian securities laws. Forward-looking statements may generally be identified by the use of words such as “will”, “continue”, “anticipate”, “expect”, “would”, “could”, “plan”, “future” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. Forward-looking statements in this press release include but are not limited to Li-Cycle’s ability to capitalize on growth opportunities, Li-Cycle’s ability to scale the business to at least 100,000 tonnes per year of Spoke processing capacity and 220,000-240,000 tonnes per year of Hub processing capacity by 2025; the expected recycling capacity of the Arizona Spoke and the Alabama Spoke and the development of a second processing line at the Alabama Spoke, the expected date of the commencement of operations for the first and second processing lines at the Arizona Spoke and the first processing line at the Alabama Spoke; continued increasing ramp-up at the Kingston Spoke and Rochester Spoke during H2 2021; and procurement of the Rochester Hub mechanical equipment during fiscal 2021.These statements are based on various assumptions, whether or not identified in this communication, which Li-Cycle believe are reasonable in the circumstances. There can be no assurance that such estimates or assumptions will prove to be correct and, as a result, actual results or events may differ materially from expectations expressed in or implied by the forward-looking statements.

These forward-looking statements are provided for the purpose of assisting readers in understanding certain key elements of Li-Cycle’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of Li-Cycle’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes and is not intended to serve as, and must not be relied on, by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Li-Cycle, and are not guarantees of future performance. Li-Cycle believes that these risks and uncertainties include, but are not limited to, the following: Li-Cycle’s inability to economically and efficiently source, recover and recycle lithium-ion batteries and lithium-ion battery manufacturing scrap, as well as third party black mass, and to meet the market demand for an environmentally sound, closed-loop solution for manufacturing waste and end-of-life lithium-ion batteries; Li-Cycle’s inability to successfully implement its global growth strategy, on a timely basis or at all; Li-Cycle’s inability to manage future global growth effectively; Li-Cycle’s inability to develop the Rochester Hub, Arizona Spoke, Alabama Spoke and other future projects in a timely manner or on budget or that those projects will not meet expectations with respect to their productivity or the specifications of their end products; Li-Cycle’s failure to materially increase recycling capacity and efficiency; Li-Cycle may engage in strategic transactions, including acquisitions, that could disrupt its business, cause dilution to its shareholders, reduce its financial resources, result in incurrence of debt, or prove not to be successful; one or more of Li-Cycle’s current or future facilities becoming inoperative, capacity constrained or if its operations are disrupted; additional funds required to meet Li-Cycle’s capital requirements in the future not being available to Li-Cycle on commercially reasonable terms or at all when it needs them; Li-Cycle expects to incur significant expenses and may not achieve or sustain profitability; problems with the handling of lithium-ion battery cells that result in less usage of lithium-ion batteries or affect Li-Cycle’s operations; Li-Cycle’s inability to maintain and increase feedstock supply commitments as well as securing new customers and off-take agreements; a decline in the adoption rate of EVs, or a decline in the support by governments for “green” energy technologies; decreases in benchmark prices for the metals contained in Li-Cycle’s products; changes in the volume or composition of feedstock materials processed at Li-Cycle’s facilities; the development of an alternative chemical make-up of lithium-ion batteries or battery alternatives; Li-Cycle’s revenues for the Rochester Hub are derived significantly from a single customer; Li-Cycle’s insurance may not cover all liabilities and damages; Li-Cycle’s heavy reliance on the experience and expertise of its management; Li-Cycle’s reliance on third-party consultants for its regulatory compliance; Li-Cycle’s inability to complete its recycling processes as quickly as customers may require; Li-Cycle’s inability to compete successfully; increases in income tax rates, changes in income tax laws or disagreements with tax authorities; significant variance in Li-Cycle’s operating and financial results from period to period due to fluctuations in its operating costs and other factors; fluctuations in foreign currency exchange rates which could result in declines in reported sales and net earnings; unfavourable economic conditions, such as consequences of the global COVID-19 pandemic; natural disasters, unusually adverse weather, epidemic or pandemic outbreaks, boycotts and geo-political events; failure to protect Li-Cycle’s intellectual property; Li-Cycle may be subject to intellectual property rights claims by third parties; Li-Cycle’s failure to effectively remediate the material weaknesses in its internal control over financial reporting that it has identified or if it fails to develop and maintain a proper and effective internal control over financial reporting. These and other risks and uncertainties related to Li-Cycle’s business are described in greater detail in the section entitled “Risk Factors” in its final prospectus dated August 10, 2021 filed with the Ontario Securities Commission in Canada and the Form 20-F filed with the SEC. Because of these risks, uncertainties and assumptions, readers should not place undue reliance on these forward-looking statements. Actual results could differ materially from those contained in any forward-looking statement.